Navigating the European market on Amazon can be daunting for sellers due to the various tax, VAT, and fulfillment requirements. To make the most of your opportunities in this market, utilizing the Amazon Revenue Calculator for Europe is essential. This tool will help you make informed decisions on pricing, profitability, and inventory management while assessing the impact of Amazon’s fees on your bottom line.

Setting up an Amazon seller account in Europe and using Fulfillment by Amazon (FBA) can provide a seamless experience for managing your sales across different countries. Understanding the FBA fees and storage costs peculiar to the European market is crucial to maintaining a profitable business venture.

Key Takeaways

- The Amazon Revenue Calculator helps estimate the European market’s pricing, profitability, and inventory management.

- Setting up an Amazon seller account and using FBA in Europe aids in efficiently managing sales across countries.

- Awareness of FBA fees, storage costs, and European taxes is essential for maintaining profitability while selling in Europe.

Account Set-Up for Selling on Amazon Europe

As an aspiring Amazon seller, beginning your journey in the European market involves a straightforward process. First, choose the selling plan that best fits your needs. Amazon offers two plans: a Professional Selling Plan and an Individual Plan.

Selling Plans

With the Professional Selling Plan, you can take advantage of many features designed for those looking to grow their business on Amazon. This plan costs £25 (excluding VAT) monthly and selling fees. Some benefits of the Professional Selling Plan include bulk product listing and eligibility for top placement on product detail pages.

On the other hand, the Individual Plan is suited for sellers who plan on selling less than 35 items per month. With this plan, you’ll pay a per-item fee instead of a monthly subscription. It’s important to note that some features, like Amazon-sponsored ads and bulk listings, aren’t available with this plan.

Registration process

Once you’ve decided on your plan, register for a seller account on Amazon. Remember to choose the European marketplace that aligns with your target customers. The available marketplaces in Europe include selling in the UK, Germany, France, Spain, and Italy.

You must provide your tax and bank account information during the registration process. Amazon offers a Currency Converter tool for those selling in multiple countries to help you manage transactions in different currencies. Ensure that your bank account can receive electronic transfers from Amazon, which is essential for your payments.

In summary, selling on Amazon Europe involves selecting a suitable plan, registering for a seller account, choosing your target marketplace, and providing your banking information. By carefully considering your options and entering the necessary information correctly, you’ll be on your way to launching a successful e-commerce venture in the European market.

Amazon FBA in European Markets

If you plan to expand your online business to the European market, the Amazon FBA program offers great opportunities for sellers in the United Kingdom, Germany, France, Italy, Spain, and other countries. By leveraging Amazon’s extensive network of fulfillment centers, you can store your products close to your customers, allowing for fast and reliable delivery.

Pan-European FBA program

As a seller on Amazon, you can access the Pan-European FBA program, which enables you to sell your products across all five Amazon European marketplaces with Prime eligibility. This means you can confidently reach millions of customers while benefiting from Amazon’s trusted 24/7 support and fast, reliable deliveries.

To start with Amazon FBA in Europe, you should create an Amazon EU selling account to list your products in the UK, Germany, France, Italy, and Spain. After listing your products, you can send your inventory to Amazon’s fulfillment centers, and they will take care of storage, picking, packing, and shipping to your customers.

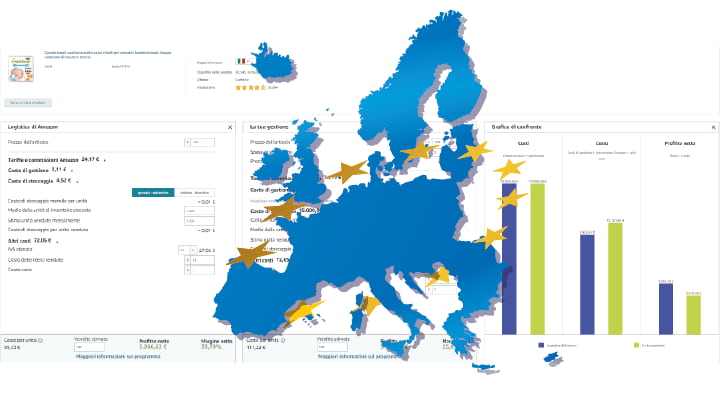

FBA Fee Calculator

Using the FBA calculator is a great way to estimate your potential revenue for the European market. Simply enter your product information, and the tool will give you an overview of the expected sales volumes, fees, and profitability for each marketplace.

Remember that, depending on the countries you’re selling in, you may need to comply with different tax and legal requirements. It’s essential to be aware of these regulations and prepare accordingly, as they may affect your business operations and financial results.

In summary, Amazon FBA in European markets can help you expand your online business, reach more customers, and benefit from Prime shipping. By considering the unique aspects of each marketplace and utilizing the FBA calculator tool, you can make informed decisions and grow your business successfully.

Understanding Amazon FBA Fees in Europe

When using Amazon’s FBA service for the European market, you must understand the different fees you’ll encounter. As a seller, you’ll be liable for fulfillment fees, storage fees, referral fees, and other miscellaneous costs. Additionally, taxes and VAT play a significant role in determining your net income from sales.

Fulfillment fees include picking, packing, and shipping your products through Amazon’s fulfillment centers. These fees vary based on the size and weight of your items. In Europe, Pan-European FBA can save you up to 56% in Euro-value fulfillment fees, depending on the countries where your products are sold.

Storage fees are charged for storing your products in Amazon’s fulfillment centers. These fees vary depending on the time of the year and the size and volume of your inventory. To minimize your storage costs, it’s essential to keep track of your inventory levels and understand the sales velocity of your products.

Referral fees are Amazon’s commission for each item sold on their platform. These fees vary depending on the product category, with most referral fees ranging from 8% to 15%. Aside from referral fees, you may also encounter additional fees like closing and subscription fees, based on your chosen selling plan.

Other costs to consider include shipping costs for sending your products to Amazon’s fulfillment centers. You might also need to factor in costs related to packaging supplies, customs, and import duties, and return processing fees.

In the European market, accounting for taxes and VAT is crucial. These charges may vary depending on your business location and the countries you’re selling in. Make sure to consult with a tax expert or use Amazon’s VAT Services to ensure compliance with relevant tax laws.

Understanding Amazon FBA fees in the European market will help you manage your sales and profits effectively. Make sure to closely monitor your costs in fulfillment, storage, and referral fees while remaining compliant with tax regulations.

Introduction to the Amazon Revenue Calculator

As an Amazon seller, understanding your potential profits and expenses is crucial in making informed decisions about which products to sell and how to price them. The Amazon Revenue Calculator is a handy tool that allows you to estimate your FBA (Fulfillment by Amazon) fees and forecast your revenue for the European market.

The Amazon Revenue Calculator is software provided by Amazon that helps you estimate the revenue you can make with your products. It considers various fees, such as FBA, referral, and shipping fees, allowing you to see how much profit you can make per sale.

To start with the FBA Revenue Calculator, you must know the product’s ASIN (Amazon Standard Identification Number) or EAN (European Article Number). Once you’ve entered this information, the calculator will display a detailed breakdown of the various fees, such as pick and pack, inbound shipping, and referral fees.

In addition to helping you understand the costs of selling on Amazon, these calculators can aid your product research. By comparing the estimated profit margins of different products, you can uncover new, profitable opportunities in the European market.

Remember, while this calculator is useful for estimating your revenue and expenses, they are not an exact science. The actual costs may vary depending on fluctuations in exchange rates, shipping rates, and other factors. However, the Amazon Revenue Calculator provides a solid starting point to make well-informed decisions about your European Amazon business.

Calculating Your FBA Revenue and Profit when Selling in Europe

When selling on Amazon in the European market, using the revenue calculator is essential for effectively estimating your net profit and margins. To use the Amazon FBA revenue calculator for the European market, you’ll need to follow these simple steps:

- Choose the marketplace: Make sure to select the appropriate European Amazon marketplace, such as Amazon UK (amazon.co.uk), Amazon Germany (amazon.de), or Amazon France (amazon.fr), depending on the region you plan to sell in.

- Locate comparable products: Search for a similar product or enter the ASIN (Amazon Standard Identification Number) of the product you want to analyze. This will allow you to calculate your revenue and profit based on realistic market conditions.

- Enter item price and cost of the product: Input the price you plan to sell and the cost you’re paying. Both of these figures are critical in determining your profit margins.

- Review Amazon fees: The calculator will display the Amazon fees associated with selling your product, including referral fees, FBA costs, and any applicable long-term storage fees. These fees can significantly impact your overall profit.

- Analyze your net profit and margins: Review the calculator’s net profit and margin breakdown. This information will help you make informed decisions and adjustments to optimize your selling strategy in the European market.

Remember, accurately estimating your FBA revenue and profit is essential for successful expansion and growth in the European market. Utilizing the Amazon revenue calculator and being mindful of marketplace selection, item pricing, product costs, and Amazon fees can provide clearer insights into your business’s financial performance.

Amazon Sales Channels in Europe

When expanding your e-commerce business to the European market, it’s important to understand the various Amazon sales channels available. Utilizing these channels can maximize your product exposure and reach a wider audience.

In Europe, Amazon operates in several countries, including the United Kingdom, Germany, France, Italy, and Spain. Each of these marketplaces has its local website, allowing you to cater to the specific needs and preferences of customers in those regions. To list your products across these sites, create an ASIN (Amazon Standard Identification Number) for each item. This unique identifier helps Amazon track and organize products within its marketplace.

To increase your chances of success, consider the following tips when using Amazon sales channels in Europe:

- Research your target market: Understand each European country’s specific demands and preferences to tailor your product listings accordingly. This will help your products stand out and attract more customers.

- Optimize your listings for each marketplace: Customize your product descriptions, titles, and images to cater to each country’s language and cultural nuances. This can lead to better conversion rates and customer satisfaction.

- Consider Fulfilment by Amazon (FBA): Amazon handles your products’ storage, packaging, and shipping in Europe. This allows you to focus on expanding your business and reaching more customers.

By following these tips and leveraging the power of Amazon’s European sales channels, you can effectively grow your e-commerce business and reach a larger international audience. Stay confident, knowledgeable, and neutral as you explore these opportunities and build your brand in the European market.

Managing Inventory and Storage Fees

As you venture into selling on Amazon’s Europe market, one vital step is to effectively manage your inventory and understand Amazon’s storage fees. Proper inventory management can help you avoid unnecessary costs and optimize profit margins.

Amazon calculates storage fees based on the daily average volume of your inventory, the product type, size tier, and the time of year. When storing inventory in Amazon’s fulfillment centers, you will encounter two main storage fees: monthly and long-term storage fees. Monthly fees are incurred for all items in storage, while long-term fees are applied to items in storage for more than 365 days. Be mindful of these fees to make the most out of your Amazon selling experience.

To help you manage your storage fees better, consider using Amazon’s weighted average approach, which takes the average daily volume of all units divided by the total days in the month to compute the fee. This lets you easily track your storage costs and plan your inventory accordingly.

Amazon does offer some free storage incentives to encourage the adoption of its fulfillment services, such as the FBA New Selection program. Be sure to explore these programs to save on storage costs potentially. Keep in mind, however, that these free storage offers are usually subject to certain conditions and time limits.

Another element to be aware of is the Aged Inventory Surcharge, which may be levied on your inventory that has been stored for an extended period (more than 365 days). This surcharge may be reduced or avoided by regularly auditing your inventory and disposing of slow-moving items through removal order fees. Removal orders allow you to have your inventory returned or disposed of to create space for new items, which can help you maintain a healthier inventory and reduce storage costs.

Remember to keep the provided information in mind and continually monitor your inventory levels, turnover rates, and storage fees. This will enable you to make well-informed decisions and ultimately improve the efficiency and profitability of your Amazon FBA business in the Europe market.

Calculating European Taxes and VAT

When selling on Amazon in the European market, it’s essential to understand the proper calculation of taxes and value-added tax (VAT) for your products. VAT rates differ across European Union countries, so ensuring accurate calculations for smooth transactions is crucial.

To begin with, you’ll need to register for VAT in seven countries where Amazon stores your inventory. If you’re a non-EU company, you may require fiscal representation in France, Spain, Italy, and Poland, which might come with additional costs. For more details on VAT registration, you can refer to this guide.

When calculating European tax and VAT, ensure that you comply with the 27 EU member states’ regulations and understand the different standard VAT rates set by each country. The EU sets the minimum standard VAT rate at 15%, with up to two reduced rates allowed per country. To find out the VAT rates for each EU country, visit this helpful page.

Amazon has developed a new FBA revenue calculator based on the European market to facilitate these calculations. This tool allows you to understand your revenue potential and factors in the VAT rates of different countries. You can learn how to use Amazon’s new FBA revenue calculator by reading this post.

Outsourcing your VAT reporting or using a European VAT service can save you time and effort, as filing taxes is required monthly or quarterly, depending on the country. Refer to their page to learn more about handling VAT on Amazon global selling.

By accurately calculating European taxes and VAT, you can protect your business from unwanted fines and maintain a smooth operation in the European market. Remember to stay updated on tax regulations and adapt your calculations when needed.

Denes, with 20 years experience in logistics, holds a Logistics Manager degree from Budapest’s Logistics Association and has penned a thesis on mobile devices. Venturing into e-commerce, Denes specializes in Fulfilled By Amazon and passionately educates others about Amazon selling techniques.