Selling on amazon.co.uk

Embrace Amazon UK as Your New Marketing Frontier

Leverage Amazon, the World’s Leading Online Retailer, for Enhanced Business Visibility

This comprehensive guide delves into the essential steps to initiate your selling journey on Amazon UK, offering a wealth of benefits for your UK business. Whether you’re just starting or are an experienced seller, this manual is packed with valuable insights.

Expand Your Reach Beyond Borders by Selling on Amazon UK

Selling on Amazon from outside the United Kingdom presents a fantastic opportunity to broaden your customer base and boost sales. This guide is your go-to resource for everything you need to know about selling on Amazon UK, including:

- The advantages of establishing your selling business on Amazon UK

- Step-by-step guidance on how to commence selling on Amazon UK

- Key strategies for achieving success while selling on Amazon in the UK

- Understanding the selling costs associated with Amazon UK

Let’s embark on this exciting journey of selling on Amazon UK!

Sell on Amazon UK Table of Contents

- Selling on amazon.co.uk

- 1. Amazon FBA for Beginners UK

- How to sell on Amazon UK?

- How does Amazon FBA work (UK)?

- 2. When selling on Amazon.co.uk, how do I maximize my earnings?

- Is Amazon FBA worth it?

- Is Amazon FBA UK profitable?

- How much do Amazon sellers make in the UK?

- How do I get paid on Amazon UK?

- 3. How much does it cost to sell on Amazon.co.uk?

- Selling on Amazon UK fees

- FBA Amazon UK calculator

- Selling on amazon.co.uk Questions and Answers

- Can I sell on Amazon just in the UK?

- Can I sell on Amazon without a UK business?

- Do I need a company to sell on Amazon UK?

- How do I set up Amazon FBA Business UK?

- What are the benefits to move your online sales to Amazon FBA?

- Why Choose Amazon UK for Your Business? A Strategic Move for Growth and Visibility

- UK Returns and Refunds: Regulations and Amazon’s Policies

- Leveraging Amazon Prime to Boost Sales in the UK

- Amazon UK’s Advertising and Promotional Tools

- Cultural and Regional Differences: Tailoring Your Strategy for the UK Shopper

- Expanding Your Amazon Business Across Europe: Opportunities in Germany and France

- Tax Implications for Amazon Sellers

- Legal Requirements for Selling in the UK

- Challenges Faced by Amazon Sellers

- Selling on Amazon UK Advanced Strategies

- FAQ: Frequently Asked Questions about selling on Amazon.co.uk

- Conclusion about Selling on Amazon.co.uk

1. Amazon FBA for Beginners UK

It’s simpler than you might think to sell on Amazon.co.uk.

Since Amazon handles all the storage, shipping, and customer service, Amazon FBA is a very effective way to sell your products.

This platform is good for those traders who wish to sell their goods online but don’t have enough time.

The sellers must purchase a few items and complete the registration form on Amazon.co.uk.

How to sell on Amazon UK?

First, you need to create an Amazon UK seller account here:

Once you have an account, time to find the right product to sell.

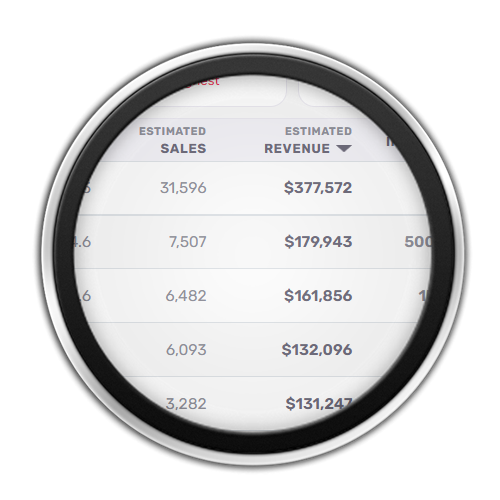

FBA Calculator

Using a tool like MarketGap FBA Calculator or Amazon Profit Spy web browser app helps you find products that are selling well on Amazon and have low competition.

Watch this video about using the tools:

Once you’ve found a product, it’s time to create your listing.

You need to create unique product images this way you can boost your sales by up to 37%.

Don’t forget to check the image requirements on Amazon before doing that.

Also, you need to create unique product descriptions with all the details.

Longer product description pages result in far more sales.

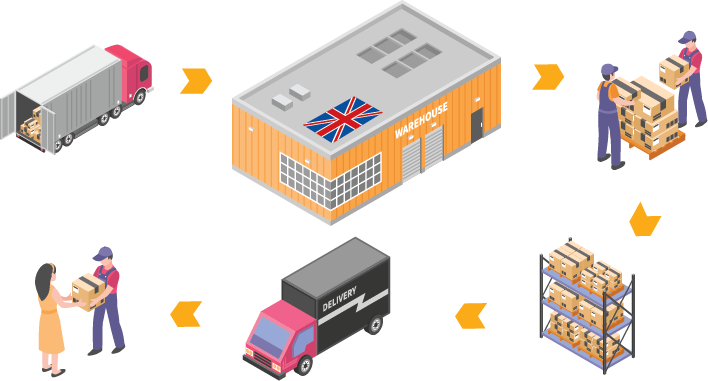

How does Amazon FBA work (UK)?

Simply deliver your goods to the Amazon warehouse, and they will handle the rest.

When consumers issue an order, Amazon will choose, pack, and ship the products for you. They will also take care of refunds and customer service.

Basically, Amazon is handling the whole procedure

- Amazon tells you which warehouse to send your items to.

- You ship your items to Amazon’s warehouse.

- Your items are stored securely in an Amazon fulfillment center.

- When customers buy your items, Amazon packs and delivers them to your customers.

- Amazon also takes care of the returns and refunds.

You should be aware of the following if you want to sell goods on Amazon UK and earn money:

2. When selling on Amazon.co.uk, how do I maximize my earnings?

Search for those kinds of items that have a large market and a good profit margin.

Offering competitive prices for your products is important,

Remember, because Amazon is a marketplace, customers constantly search for the best offers.

Apart from the price of the product, shoppers consider factors such as shipping costs and delivery times before choosing a seller to purchase from.

Therefore, offering free shipping and fast delivery could be your advantage if you want to make money selling on Amazon UK.

Finally, creating informative listings that accurately describe your products is also important.

Use keyword-rich titles and descriptions to help your listings rank highly in search results.

These suggestions will help you sell on Amazon.co.uk:

- Search for items with a large market and good profit margins on Amazon UK.

- Offer competitive prices to stand out in the Amazon marketplace.

- Understand that customers on Amazon.co.uk are looking for the best offers.

- Consider shipping costs and delivery times; these are crucial for Amazon buyers.

- Offer free shipping and fast delivery to gain an advantage in Amazon sales.

- Create informative and accurate product listings on Amazon UK.

- Understand the dynamics of an Amazon business in the UK and adapt your strategies.

- Focus on customer satisfaction to build a reputable Amazon selling business.

- Stay updated with Amazon’s policies and market trends in the UK.

- Utilize Amazon’s tools and services, like Amazon Prime and Fulfillment by Amazon (FBA), to enhance your selling experience.

- Consider the legal aspects of selling on Amazon in the United Kingdom, including VAT and business regulations.

Is Amazon FBA worth it?

Yes, Amazon FBA is definitely worth it!

Using Amazon FBA is a fantastic approach to expose your products to a wide market at a low initial cost.

In addition, Amazon handles order processing and customer service inquiries, so you won’t have to.

And, best of all, you can start with Amazon FBA for any budget!

So what are you waiting for?

Try it out and observe how much it improves your life.

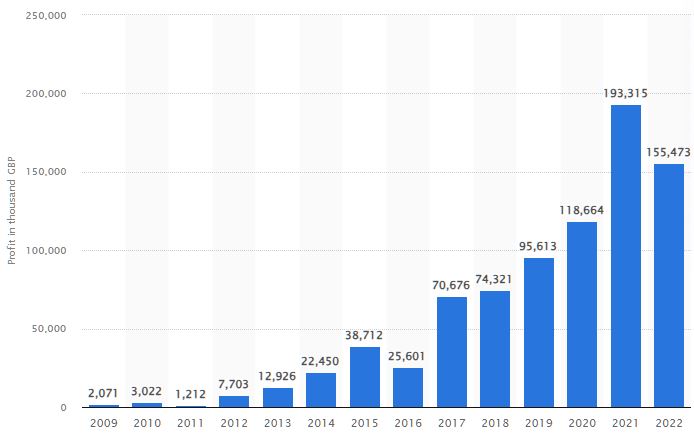

Is Amazon FBA UK profitable?

Yes, absolutely.

The data doesn’t lie, therefore I’m saying it.

In 2022, Amazon UK earned a staggering $155.473 billion in revenue. A good portion still came from their third-party sellers – which is where you come in.

So, the answer to your question is a resounding yes – Amazon FBA UK could be very profitable.

It’s one of the best markets for Amazon sellers to sell into.

But there’s a catch… The competition is brutal. According to Cybercrew, there were 281,257 sellers on Amazon UK in 2019 – and that number is only going up. This means you’ll need to perform high to achieve your goals.

How much do Amazon sellers make in the UK?

Because seller earnings are highly variable based on factors such as the products sold, the prices set, and the fees paid to Amazon, there is no universally accurate answer to this question.

However, we can gain some understanding by looking at Amazon’s internal data.

In 2018, Amazon UK announced in the news that its top-selling sellers had generated combined sales of £160 million in the previous 12 months.

Considering that they are the highest-earning sellers on the site, this amounts to an average of £4 million individually.

The vast majority of sellers earn much less than this.

For example, a 2017 study found that the median annual revenue for Amazon UK sellers was just £12,000.

So, while there are certainly some big money earners on Amazon UK, the average seller is far from raking in millions.

How do I get paid on Amazon UK?

As an Amazon seller, you have 3 different options for getting paid.

Bank transfer

The most common method and recommended way to deposit your payments directly into your bank account.

This is the quickest and most convenient payment method, as you may immediately put your money to use.

Amazon’s Gift Card

Another option is to use Amazon’s Gift Card balance. I recommend it only for those who sell very few items.

This method enables you to get your payments via an Amazon.co.uk Gift Card. These can be used to make purchases on Amazon or cashed out through several different methods.

This option has a few concerns:

First, you’ll need to have a minimum balance of £25 in order to receive a gift card.

And second, there may be some fees associated with cashing out your gift card balance.

Check

Finally, you can choose to have your payments sent by check.

This is typically the slowest way to get paid.

Remember that the processing time for a check payment might be up to 10 days.

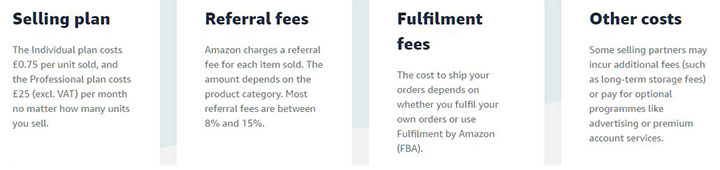

3. How much does it cost to sell on Amazon.co.uk?

Some variables can affect the total price of selling on Amazon.co.uk.

You should start by calculating how much it will cost to list your Amazon products.

Selling on Amazon UK fees

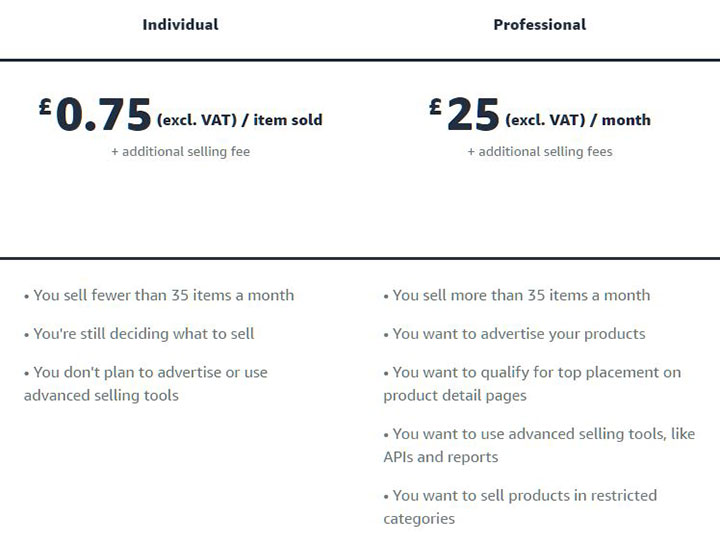

Amazon FBA Selling plans amazon.co.uk

Amazon offers two different selling options so that you may pay for each sale or sign up for a fixed monthly price. Your plan is completely flexible and can be changed or terminated at any time.

Individual Plan: £0.75 (excl. VAT) / item sold + additional selling fee

It’s for you when you:

- Only sell less than 35 items each month.

- Still deciding what product to sell.

- Don’t want to promote your products or use selling tools.

Professional Plan: £25 (excl. VAT) / month + additional selling fees

It’s for you when you:

- Sell more than 35 items every month.

- Wish to promote your items.

- Want to rank high on product detail pages

- Would use selling tools like APIs and reports.

- Want to sell items that have restricted categories.

Referral Fees

Each item sold results in a referral fee for selling partners. Amazon deducts the correct referral fee percentage from the total sales price for all items. The total sales price is the full amount paid by the client, including the item price and any delivery or gift-wrapping costs.

Referral fees depend on the product category.

Fulfillment fee

A fixed charge per unit, depending on the product type, size, and weight.

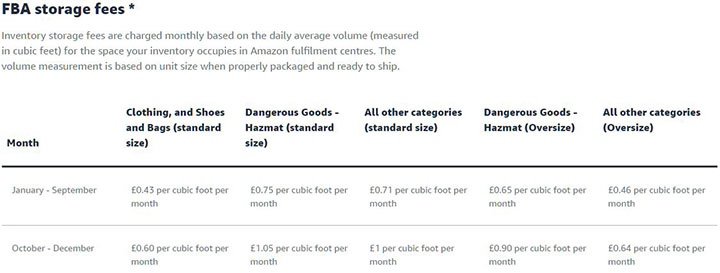

FBA storage fees

Per month, you will be charged according to the number of cubic feet stored in Amazon fulfillment centers. The volume measurement is calculated based on unit size after the product has been properly packed and ready to ship.

Storage fee also depends on the product category such as:

- Clothing, Shoes and Bags (standard size)

- Dangerous Goods – Hazmat (standard size)

- All other categories (standard size)

- Dangerous Goods – Hazmat (Oversize)

- All other categories (Oversize)

Keep in mind that storage fees change with the seasons. It’s cheaper to store your products from January – September than October – December.

From May 12, 2022, a 4.3% fuel and inflation surcharge will be charged to FBA fulfillment fees, with the exception of return processing costs.

Other costs

When calculating the total cost of selling in Amazon stores, keep in mind any additional selling costs you may incur, as well as other optional programs that might help you boost sales.

UK Additional selling fees

- Inventory fees

- High-volume listing fees

- Refund administration fee

Amazon Optional programs

- Advertising

- Fulfillment by Amazon

- Amazon partnered with a carrier program

After getting your products listed on Amazon, you should think about investing in some targeted advertising there.

As you can see, the pricing of FBA Amazon UK fees varies according to your product and business model, but it’s crucial to consider all of the possible expenses before diving in.

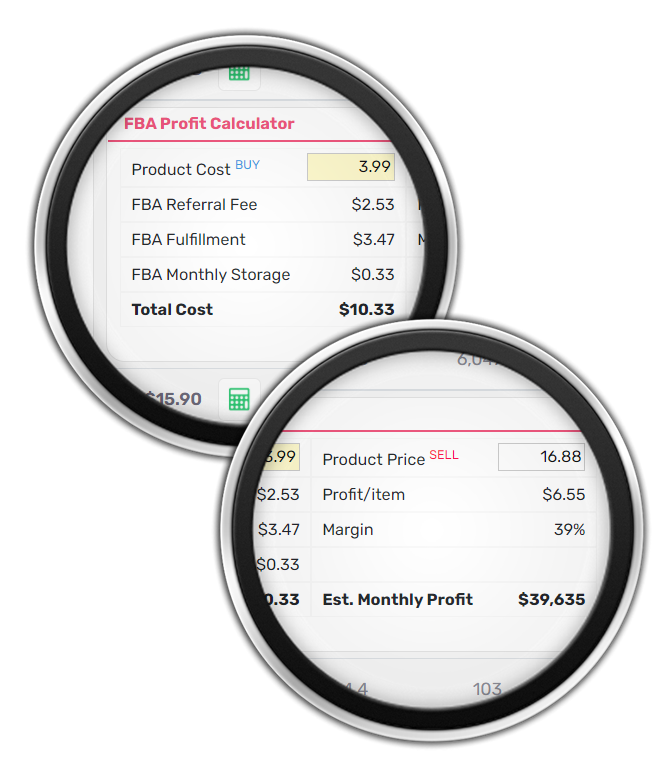

FBA Amazon UK calculator

It’s no secret that Amazon charges a lot of fees for its FBA program.

These fees can potentially cut into your profits if you are not attentive.

But there’s a way to make sure you always know exactly how much you’ll be paying in fees use the MarketGap FBA calculator or MarketGap’s Profit Spy. You can search for any product on Amazon and calculate the total price. Just enter the product’s price, and the calculator will display all the applicable fees.

This greatly enhances your ability to monitor how much you spend.

The tool is available for free trial.

If you want to be sure about your Amazon costs, the MarketGap FBA calculator is the right tool.

Selling on amazon.co.uk Questions and Answers

Can I sell on Amazon just in the UK?

Yes, you can just sell on Amazon in the UK.

In fact, it’s probably one of the best markets for selling on Amazon because of the high demand for English-language products.

However, there are a few things to keep in mind if you’re going to be selling just in the UK.

- Before selling in the UK, check that the goods comply with all applicable laws.

- Second, you’ll need to set up your shipping so that it’s cost-effective for customers in the UK.

- Finally, you’ll need to set up your pricing so that it’s competitive with other sellers in the UK market.

If you can do all of those things, then you’ll be well on your way to success as an Amazon seller in the UK market.

Can I sell on Amazon without a UK business?

Yes, you can sell on Amazon without a UK business or UK Ltd.

You must set up an account with Amazon and then list your products for sale.

There are several charges to selling on Amazon, but with a small budget, you can list your items.

Amazon’s fulfillment services handle shipping and customer service for you.

While selling on Amazon can be profitable, it’s important to study the associated fees and obligations before diving in.

Do I need a company to sell on Amazon UK?

No, you don’t need a company to start selling on amazon.co.uk.

You must create an Amazon business account before listing your products for sale.

However, there are some upsides to establishing a business:

- Businesses can avoid paying value-added tax by registering for VAT. If you’re selling expensive things, this might be a huge plus.

- A company checking account might simplify monitoring cash flow and paying bills on time.

- Companies can provide more credibility to buyers, leading to more sales.

A competent accountant or lawyer will be able to give you the best guidance for your specific situation if you’re thinking of forming a company to sell on Amazon UK.

How do I set up Amazon FBA Business UK?

You’ll need to set up a few things before you can launch your Amazon FBA business in the UK.

- First, you must source a provider capable of getting your goods to Amazon’s UK fulfillment centers.

- You’ll also need to create a listing and an SKU for your product on Amazon.co.uk, and make sure that your listing complies with Amazon’s guidelines.

- To get people to look for your goods on Amazon, you can either pay to promote it there or work to achieve a high organic search engine ranking for terms related to your product.

Setting up a profitable Amazon business in the UK depends on your ability to attract a large number of buyers to your listings.

What are the benefits to move your online sales to Amazon FBA?

According to amazon.co.uk when selling partners moved their items to FBA in the UK, they experienced a 35% sales boost on average* as a result of faster delivery that delighted clients.

Why Choose Amazon UK for Your Business? A Strategic Move for Growth and Visibility

Embrace the Potential of Amazon UK for Business Expansion

Amazon UK emerges as a pivotal ecommerce hub in Europe, offering an unparalleled opportunity for businesses to amplify their presence and sales. This platform is not just a marketplace; it’s a gateway to a broad and trusting customer base ready to explore and purchase a wide range of products.

Seamless Transition to Amazon UK for Experienced Sellers

For those already versed in Amazon’s ecosystem, whether in the USA or other global markets, adapting to Amazon UK is a breeze. The platform maintains consistency in its user interface, including the dashboard and performance metrics, ensuring a smooth and familiar operational experience. This uniformity extends to Amazon’s comprehensive seller tools, designed to streamline your business processes.

Leveraging Amazon UK’s Marketplace for Brand Amplification

Listing your products on Amazon UK means more than just selling; it’s about engaging with a diverse, extensive audience. Amazon UK equips sellers with robust tools, encompassing advertising options and Fulfillment by Amazon (FBA), to enhance sales on Amazon strategies and elevate brand visibility. This approach not only facilitates access to a vast European market but also offers the convenience of Amazon’s established logistics and customer service network.

UK Returns and Refunds: Regulations and Amazon’s Policies

UK’s Return Laws

The UK has specific regulations concerning product returns and refunds. Sellers must be aware of these laws to ensure compliance and maintain customer trust.

Amazon’s Return and Refund Policies in the UK

Amazon UK has its policies aligned with UK regulations, ensuring sellers and customers have a clear understanding of return and refund processes.

Customer Support

Amazon UK’s Customer Support provides comprehensive assistance to sellers, guiding them through the intricacies of returns and refunds to ensure a smooth experience for both businesses and consumers.

Leveraging Amazon Prime to Boost Sales in the UK

Prime: The Badge of Trust and Speed

Amazon Prime, with its promise of fast shipping and exclusive deals, attracts a vast number of loyal customers. Sellers can leverage this service to boost their sales on amazon and enhance customer trust.

Selling on Amazon UK with Prime Benefits

By enrolling in Amazon Prime, sellers can offer customers added benefits, from faster shipping to exclusive deals, enhancing their brand’s appeal and driving sales on amazon.

Amazon UK’s Advertising and Promotional Tools

Advertise with Amazon: Boosting Product Visibility

Amazon UK offers a suite of advertising tools to automate the process, from sponsored products to brand badges, allowing sellers to enhance their product’s visibility to more unique visitors and drive sales.

Sales and Promotional Tools

Beyond advertising, Amazon UK provides promotional tools like lightning deals and discounts, enabling sellers to attract more customers and increase sales.

Performance metrics

Amazon UK’s Advertising Performance metrics provide sellers with insightful data, enabling them to evaluate the effectiveness of their ad campaigns and refine their marketing strategies for optimal results.

Cultural and Regional Differences: Tailoring Your Strategy for the UK Shopper

UK Shopper’s Preferences

The UK market has its cultural and regional nuances. Sellers must tailor their strategies, from product listings to advertising, to resonate with the UK audience.

Customer Insights and Leveraging Research

By diving deep into market research and understanding customer feedback, sellers can adapt their strategies to meet the unique needs and preferences of the UK shopper.

Expanding Your Amazon Business Across Europe: Opportunities in Germany and France

Amazon’s European Expansion Beyond the UK

The Amazon platform extends its reach well beyond the United Kingdom, opening doors for sellers in various European countries, notably in the German (DE) and French (FR) marketplaces. These regions present unique opportunities for businesses to broaden their customer base and increase sales.

Germany (DE): A Gateway to Europe’s Ecommerce Platform Giant

Germany (DE) is recognized as a major player in the European ecommerce arena. By venturing into Amazon DE, sellers can tap into a large, prosperous market. The German (DE) consumer market places a strong emphasis on product quality and efficiency. Success in the Amazon DE marketplace requires sellers to ensure their products adhere to high standards and that their listings are meticulously translated to appeal to the German (DE) audience. For more insights, refer to our detailed blog post.

France (FR): Capitalizing on the French Ecommerce Scene

France’s rich cultural backdrop and varied consumer demographics create a distinctive marketplace. Amazon FR stands as a prominent platform in France, offering sellers a chance to thrive by aligning with the preferences and values of French consumers. To excel in this market, sellers should focus on the authenticity and quality of their offerings, along with providing listings in French. Additionally, tuning into local holidays and trends can be a strategic move to tailor sales approaches for the French market.

Understanding Regulations Across European Amazon Marketplaces

Navigating the diverse regulations of each European country, from VAT requirements to return policies, is crucial for sellers. Being well-informed and compliant with these varying regulations is key to successful and seamless selling experiences across Amazon’s European marketplaces.

Tax Implications for Amazon Sellers

United Kingdom VAT for International Sellers

Value Added Tax (VAT) is a consumption tax levied on the sale of goods and services in the UK. For international sellers, understanding VAT is crucial as it impacts pricing and profitability. Sellers from outside the UK need to be aware of the VAT threshold and the process of registering for VAT if their sales exceed this threshold.

UK VAT Rates and Categories

Different VAT rates apply to various product categories. Sellers should familiarize themselves with these rates to set appropriate pricing.

Income Tax Considerations

Income generated from sales on Amazon.co.uk is subject to income tax. Sellers need to declare their earnings and may need to pay tax based on the tax laws of their resident country and any tax treaties with the UK.

UK Tax Deductions and Allowances

Sellers can benefit from various tax deductions and allowances, which can reduce their taxable income.

UK Double Taxation Agreements

Many countries have double taxation agreements with the UK, which ensures that income is not taxed twice. Sellers should consult with tax professionals to understand these agreements and their implications.

Legal Requirements for Selling in the UK

Product Compliance and Standards

Products sold in the UK must meet specific standards and regulations. Sellers should ensure their products comply with UK safety standards, labeling requirements, and other relevant regulations.

Amazon UK Eco-friendly Packaging Requirements

With the increasing emphasis on sustainability, sellers should be aware of eco-friendly packaging requirements in the UK.

Import and Export Regulations

For international sellers, understanding the import and export regulations is crucial. This includes understanding customs duties, import VAT, and any documentation required for shipping goods into the UK.

Customs Declarations and Paperwork

Proper documentation is essential for smooth customs clearance. Sellers should ensure they have all the necessary paperwork in order.

Post-Brexit Changes

Following Brexit, there have been changes in import and export regulations between the UK and the EU. Sellers should stay updated on these changes to ensure smooth operations.

Challenges Faced by Amazon Sellers

Selling Competition and Market Saturation

Amazon.co.uk is a competitive marketplace with many sellers offering similar products. New sellers may find it challenging to establish a foothold and differentiate their offerings.

Sell on Amazon Business Strategies to Stand Out

Effective branding, unique product offerings, and excellent customer service can help sellers stand out in a crowded marketplace.

UK Amazon Algorithms Changes

UK Amazon’s algorithms, which determine product rankings and visibility, are continually evolving. Sellers need to stay updated and adapt their strategies accordingly.

Staying Updated with Algorithm Changes

Regularly attending UK Amazon business webinars and participating in seller forums can help sellers stay informed about algorithm updates.

Feedback and Review Management

Managing customer feedback and reviews is crucial for maintaining a positive seller reputation. Negative reviews can impact sales, and sellers need strategies to address and mitigate such feedback.

Responding to Negative Reviews

Timely and professional responses to negative reviews can help mitigate their impact and show customers that the seller values their feedback.

Selling on Amazon UK Advanced Strategies

Utilizing Amazon Advertising

UK Amazon offers various advertising solutions, from sponsored products to display ads. Leveraging these tools can boost product visibility and sales.

Maximizing ROI on Ads

Effective ad targeting and budget management can help sellers maximize their return on investment.

Amazon Selling to Other Marketplaces

Sellers can expand their reach by listing on multiple Amazon marketplaces. This involves understanding the nuances of each marketplace and adapting strategies accordingly.

Selling of Multi-Marketplace Benefits

Selling across multiple Amazon marketplaces can diversify revenue streams and reduce dependency on a single market.

Localizing Listings for International Markets

For success in international marketplaces, sellers should localize their product listings. This includes translation content, understanding local preferences, and adjusting pricing.

FAQ: Frequently Asked Questions about selling on Amazon.co.uk

Is selling on Amazon profitable UK?

Yes, selling on Amazon can be profitable in the UK. However, profitability depends on the niche, product sourcing, pricing strategy, and ability to manage expenses.

Do I need a company to sell on Amazon UK?

No, you don’t necessarily need a company to sell on Amazon UK. You can sell as an individual. However, having a registered business can offer certain advantages like potential tax benefits and a more professional presence.

What sells well on Amazon UK?

Amazon UK categories

Popular categories on Amazon UK include electronics, books, clothing, toys, and home and garden products. However, specific best-selling items can vary based on trends, seasons, and market demands.

How to make money on Amazon UK?

To make money on Amazon UK:

- Research profitable niches or products.

- Source products at competitive prices.

- Create high-quality product listings with clear photos and descriptions.

- Use Amazon’s advertising tools to boost visibility.

- Provide excellent customer service to get good reviews.

How much do Amazon sellers make in UK?

Earnings for Amazon sellers in the UK vary widely. Some may earn a few hundred pounds a month, while others can make thousands or even millions annually. It depends on the products, volume of sales, and the seller’s strategies.

How much does it cost to start selling on Amazon UK?

Starting costs for Amazon UK include a monthly subscription fee of £25 (excl. VAT) for a Professional selling plan. Individual sellers pay £0.75 per item sold. Additional fees include referral fees, which vary by category, and potential fulfillment fees if using Amazon’s Fulfillment by Amazon (FBA) service.

Do you need VAT to sell on Amazon UK?

If you exceed the VAT threshold or expect to, you’ll need to be VAT registered and charge VAT on your sales. Amazon provides a VAT calculation service for sellers to help manage this.

How do you get paid from Amazon?

Amazon pays sellers every 14 days directly to their bank account. Before transferring, they deduct any Amazon fees, refunds, and other charges.

What products are best to sell on Amazon?

Best-selling products on Amazon vary by region and time. Generally, products with high demand, low competition, and good margins are ideal.

Examples of Amazon FBA products

Examples might include unique niche products, private-label goods, or in-demand seasonal items.

Who is Amazon’s biggest competitor UK?

As of the last update, Amazon’s biggest competitors in the UK include eBay, Argos, and traditional retailers like Tesco, John Lewis, and ASDA. However, competition can vary based on specific niches and market segments.

What is the most sold item?

This varies over time and by region. Globally, products like smartphones, books, clothing, and household items are consistently popular. Specific best-sellers can be determined by checking Amazon’s best-seller lists.

Is Amazon good in the UK?

Yes, Amazon is popular and widely used in the UK. It’s known for its vast product selection, Prime benefits, and quick delivery options.

Do Amazon sellers pay taxes UK?

Yes, Amazon sellers in the UK are required to pay taxes on their income. This includes income tax, corporation tax (if operating as a company), and VAT if they exceed the threshold.

How many UK sellers on Amazon?

The exact number fluctuates, but as of the last known data, there were over 200,000 UK-based sellers on Amazon.

How much tax does Amazon business pay in the UK?

The amount of tax Amazon business can pay in the UK varies yearly based on its reported profits and applicable tax rates.

VAT cost

There have been controversies in the past regarding Amazon’s tax strategies in the UK, but specific figures can be found in their annual financial statements.

What is Amazon FBA UK business?

Amazon FBA

Amazon FBA (Fulfillment by Amazon) in the UK is a service where Amazon handles storage, packaging, and shipping on behalf of sellers. Sellers send their products to Amazon’s fulfillment centers, and when a sale is made, Amazon picks, packs, and ships the product.

Why is Amazon UK different?

Amazon UK

Amazon UK (amazon.co.uk) is tailored for the British market, with products, pricing, promotions, and services that cater specifically to UK consumers. The selection, pricing, and features might differ from other Amazon regional sites to reflect local tastes, trends, and regulations.

How long does Amazon UK take?

Delivery times on Amazon UK vary based on the product, its availability, and the chosen delivery option. For Amazon Prime members, many products are available for next-day delivery. However, standard deliveries can take between 1 to 5 days, depending on various factors.

Which are the Best Books on Selling on Amazon?

The best business books on Selling on Amazon are:

- 1. Amazon Selling Blueprint by Scott Voelker

- 2. FBA: Building an Amazon Business by Ged Cusack

- 3. Product Research 101 by Renae Clark

What percentage of people use Amazon UK?

Exact percentages can change over time. However, as of the last update, a significant portion of the UK’s online shopping population uses Amazon, making it one of the most popular e-commerce platforms in the country.

How big is Amazon UK market?

Amazon UK

Amazon UK is one of the leading e-commerce platforms in the country. While exact market size figures can change, Amazon UK has consistently maintained a significant share of the UK’s online retail market.

Which country is Amazon’s biggest customer?

The United States is Amazon’s largest market in terms of sales and revenue, as it is where the company originated and has its largest customer base.

Is Amazon the biggest online retailer in the UK?

Yes, as of the last update, Amazon is the biggest online retailer in the UK, holding a dominant position in terms of market share and customer reach.

VAT-related questions for selling on Amazon UK

Please note that the information provided here regarding Value Added Tax (VAT) for selling on Amazon in the United Kingdom is intended for general guidance and informational purposes only. It should not be considered professional tax or legal advice.

Always contact an accounting expert from London, United Kingdom, before making any financial decisions.

Does Amazon pay my VAT UK?

No, it’s the seller’s responsibility to register for, charge, and remit VAT in the UK.

VAT cost calculation

However, Amazon does offer VAT calculation and submission services to help sellers manage their VAT obligations.

Does Amazon avoid tax in UK?

Amazon has been criticized in the past for its tax strategies in the UK. The company uses legal tax arrangements that have sometimes resulted in lower tax payments than some expect. However, Amazon maintains that it pays all taxes required by law in every jurisdiction it operates in.

Does Amazon charge VAT on seller fees UK?

Yes, Amazon charges VAT on seller fees for UK-based sellers. If you are VAT registered, you can generally reclaim this VAT.

How can I avoid VAT tax?

Legally avoiding VAT isn’t straightforward, especially if your turnover exceeds the VAT threshold. However, some strategies businesses use.

Legal strategies for Ecommerce sellers

- Staying below the VAT registration threshold by limiting sales.

- Structuring the business so that separate entities or divisions fall below the threshold.

- Selling zero-rated or exempt goods or services. Always consult with a tax advisor before making decisions.

What percentage is VAT on Amazon UK?

The standard VAT rate in the UK is 20%. This applies to most goods and services, including those sold on Amazon UK.

Do I have to pay taxes on reselling items UK?

Yes, if you’re buying items with the intent to resell them for a profit, you are engaged in a business activity and are liable to pay taxes on the profit you make.

VAT

This includes income tax and potentially VAT if you exceed the registration threshold.

Can I sell in UK without VAT?

Yes, you can sell in the UK without charging VAT if your taxable turnover is below the VAT registration threshold. However, once you exceed the threshold, you are legally required to register for VAT and charge it on your sales.

How much is VAT in UK?

The standard VAT rate in the UK is 20%. There are also reduced rates (e.g., 5%) for certain goods and services, and some items are zero-rated or exempt.

Are referral fees on Amazon.co.uk inclusive of VAT?

Yes, Amazon’s referral fees are calculated based on the total sales price, including VAT.

What is the importance of including a VAT number when selling on Amazon.co.uk?

Including a VAT number is crucial for tax purposes, especially when selling across Europe, as it impacts how VAT is calculated and reported.

Conclusion about Selling on Amazon.co.uk

Denes, with 20 years experience in logistics, holds a Logistics Manager degree from Budapest’s Logistics Association and has penned a thesis on mobile devices. Venturing into e-commerce, Denes specializes in Fulfilled By Amazon and passionately educates others about Amazon selling techniques.